Long Call Calendar Spread

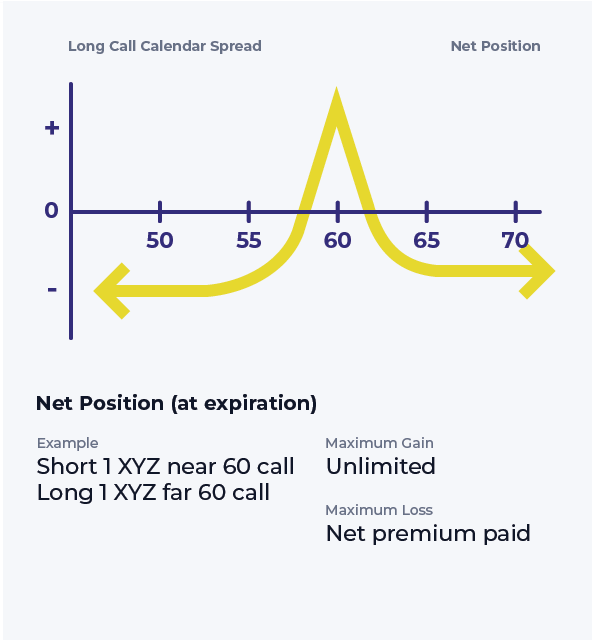

Long Call Calendar Spread - A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. This is a wager on a moderate price increase or rising volatility in. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A long calendar spread is a good strategy to use when you expect the.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

This is a wager on a moderate price increase or rising volatility in. A long calendar spread is a good strategy to use when you expect the. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. Calendar spreads are a great way to combine.

Calendar Spread Using Calls Kelsy Mellisa

A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. Learn how to create and manage a long calendar spread with calls, a strategy that.

Calendar Call Spread Strategy

This is a wager on a moderate price increase or rising volatility in. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A trader.

Long Calendar Spreads Unofficed

A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Learn how to create and manage a long calendar.

Investors Education Long Call Calendar Spread Webull

Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar spread is a good strategy to use when you expect the. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A.

Calendar Call Spread Options Edge

This is a wager on a moderate price increase or rising volatility in. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A.

Long Call Calendar Spread Options Strategy

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A long calendar spread is a good strategy to use when you expect the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A.

Long Calendar Spread with Calls Strategy With Example

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. A long calendar spread is a good strategy to.

A long calendar spread is a good strategy to use when you expect the. This is a wager on a moderate price increase or rising volatility in. A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the.

Learn How To Create And Manage A Long Calendar Spread With Calls, A Strategy That Profits From Neutral Or Directional Stock Price Action Near The.

This is a wager on a moderate price increase or rising volatility in. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. A long calendar spread is a good strategy to use when you expect the.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)