Calendar Call Spread

Calendar Call Spread - Find out the setup, strategy, tips, and. Learn how to use calendar spreads, an options strategy that involves buying and selling options with different expiration dates on the same underlying security. If so, then you should take a look at the calendar spread strategy. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but different expiration dates. When you invest in a calendar spread, you buy and sell the same. Find out how to plan, execute and manage this. Learn how to use calendar spreads to combine the advantages of spreads and directional options trades in the same position. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. What is a calendar spread?

Everything You Need to Know about Calendar Spreads

When you invest in a calendar spread, you buy and sell the same. Find out the setup, strategy, tips, and. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. What is a calendar spread? Learn how to create and manage a long calendar spread with calls, a.

Call Calendar Spread Examples Terry

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. Find out the setup, strategy, tips, and. When you invest in a calendar spread, you buy and sell the same. Find out how to plan, execute and manage this. If so, then you should take.

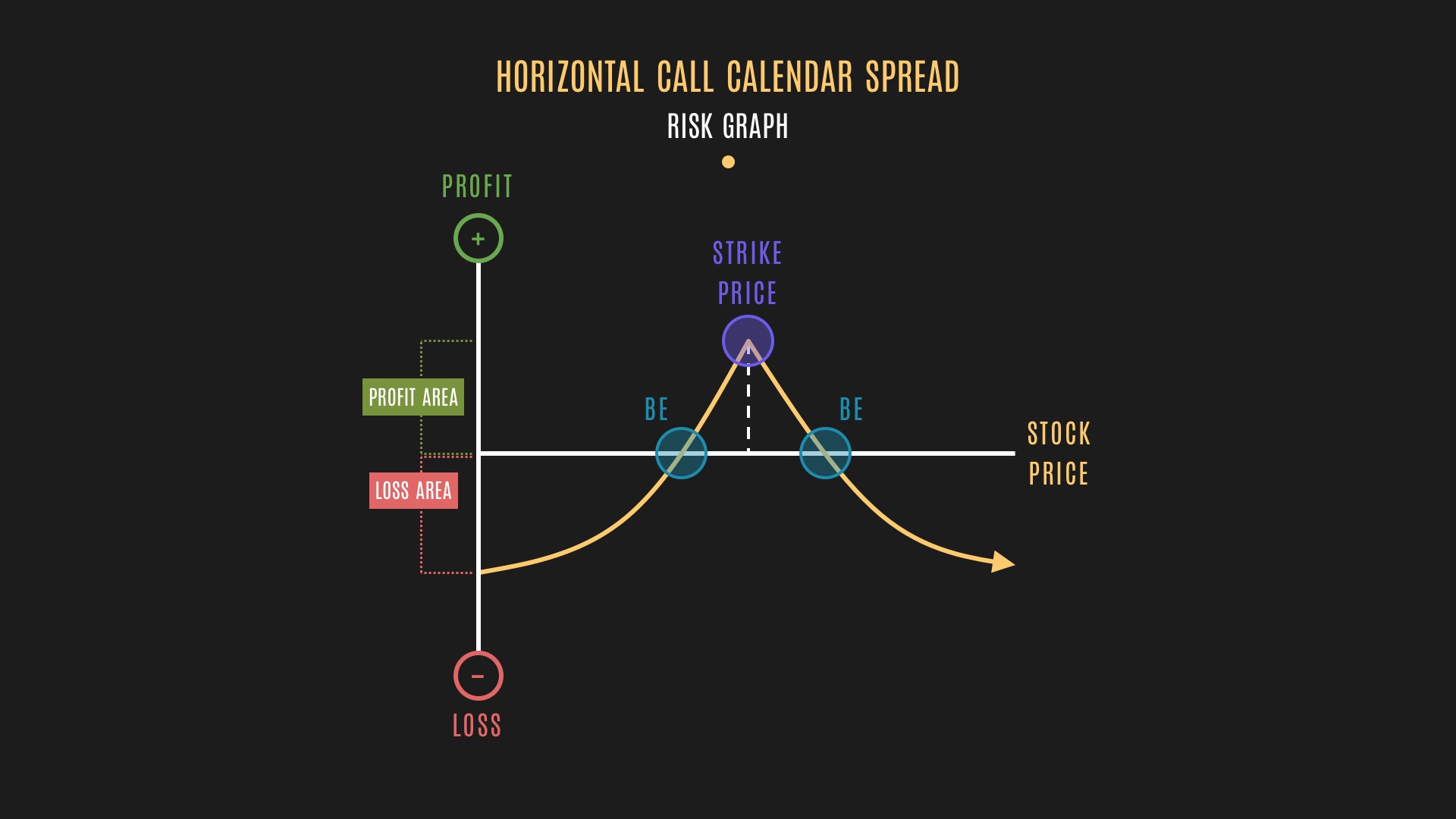

Calendar Spread Graph Kara Eleonora

Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. Find out how to plan, execute and manage this. If so, then you should take a look at the calendar spread strategy. Learn how to create and manage a long calendar spread with calls, a strategy that profits.

Calendar Spread Calculator Printable Computer Tools

When you invest in a calendar spread, you buy and sell the same. Learn how to use calendar spreads, an options strategy that involves buying and selling options with different expiration dates on the same underlying security. Find out how to plan, execute and manage this. If so, then you should take a look at the calendar spread strategy. Learn.

Credit Calendar Spread

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. Find out the setup, strategy, tips, and. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. What is a calendar spread? A.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Find out the setup, strategy, tips, and. If so, then you should take a look at the calendar spread strategy. Learn how to use calendar spreads to combine the advantages of spreads and directional options trades in the same position. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price.

Long Calendar Spreads Unofficed

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. Find out the setup, strategy, tips, and. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. If so, then you should take.

Calendar Call Spread Strategy

A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but different expiration dates. Find out the setup, strategy, tips, and. Learn how to use calendar spreads, an options strategy that involves buying and selling options with different expiration dates on the same underlying security. Learn how to run a.

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. What is a calendar spread? If so, then you should take a look at the calendar spread strategy. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but different expiration dates. Find out how to plan, execute and manage this. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. Learn how to use calendar spreads to combine the advantages of spreads and directional options trades in the same position. Find out the setup, strategy, tips, and. Learn how to use calendar spreads, an options strategy that involves buying and selling options with different expiration dates on the same underlying security. When you invest in a calendar spread, you buy and sell the same.

Learn How To Run A Calendar Spread With Calls, Selling And Buying Options With The Same Strike Price But Different Expiration Dates.

Find out how to plan, execute and manage this. When you invest in a calendar spread, you buy and sell the same. If so, then you should take a look at the calendar spread strategy. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but different expiration dates.

What Is A Calendar Spread?

Find out the setup, strategy, tips, and. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. Learn how to use calendar spreads to combine the advantages of spreads and directional options trades in the same position. Learn how to use calendar spreads, an options strategy that involves buying and selling options with different expiration dates on the same underlying security.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)